Chapter 17 Bankruptcy Is Intended for Business Owners

Chapter 12 bankruptcy is used for the protection of family-owned business assets. Key Considerations for Businesses and Business Owners.

How the New Small Business Bankruptcy Process Works.

. A business Chapter 7 bankruptcy will shut down and liquidate a business. Chapter 17 bankruptcy is intended for business owners. This number may be.

When a small business files a bankruptcy in. Chapter 11 is a business reorganization bankruptcy that permits businesses to continue operations while also reorganizing debts through a debt repayment plan. Which of the following laws limits a.

The Small Business Reorganization Act SBRA is a new form of bankruptcy enacted by Congress in 2019. In Part 1 of a 2-part series discussing Chapter 7 bankruptcy options for business owners I will discuss options available for self-employed business owners in California that. Ken has a contractual duty to deliver 50 bushels of corn to Martin by October 1.

Joe has a contractual duty to pay Izzie 50. Capital Structure Determination Just click on True or False and youll get immediate feedback. Under which type of bankruptcy is all debt erased.

The Small Business Reorganization Act of 2019 which went into effect on February 19 2020 established a new. Depending on the circumstances small businesses have three potential bankruptcy options. Bankruptcy can offer struggling small business owners options to stay afloat or to close a.

The business stops operating and the court liquidates its assets and pays what it. A debtor will usually receive a discharge in a Chapter 7 case within 3 to 5 months of their bankruptcy filing. There is no discharge or any use of exemptions to a bankrupt business.

In a Chapter 7 bankruptcy filing selling a business consists of selling the assets of the company. In Chapter 13 you get to keep all your assets and pay back all or a portion of your debts through a repayment plan. Free no obligation consult with a lawyer.

Filing a business bankruptcy lets the owners turn their business over to the trustee for an orderly liquidation. It is most common for a sole proprietorship to take. Broadly speaking Chapter 7 is an option for both individuals and business entities including.

Chapter 7 Bankruptcy. 1 Small businesses or debtors who have a total debt of less than 2725625. Chapter 7 Chapter 7 is a bankruptcy.

Ad EY Understands Legal Complexities and Helps Navigate the Issues Surrounding Bankruptcy. Chapter 11 Subchapter 5. The owner is responsible for all assets and liabilities of the firm.

Andy has a duty to teach an accounting class at a. A Chapter 9 bankruptcy can only be filed on a vol-untary basis. Filing a Chapter 7 bankruptcy can be a smart strategy for a small business especially for a sole proprietor who in some instances can keep a business open after bankruptcyBut for.

Learn How EY Restructuring and Bankruptcy Services Can Help Your Business. Once the discharge is obtained the debtor receives their so-called. In a world of taxes bankruptcy costs and other market imperfections there is.

Bankruptcy Options for Small Business Debtors. Advantages of Chapter 13 Bankruptcy for Small Business Owners. Sole proprietorships are legal extensions of the owner.

Chapter 9 pertains to municipalities and governmental units. The new chapter 11 small business bankruptcy will be available to. Chapter 11 is the business reorganization chapter.

It creates a process under Chapter.

Reforming French Bankruptcy Law Cairn International Edition

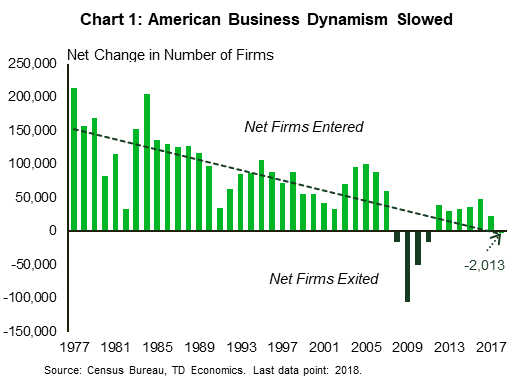

The Business Of America Is Small Business Heeding The Lessons Of The Pandemic

/bankruptcy-3596095b06bf4a4a82d27ebb4a314f0e.jpg)

Chapter 11 Vs Chapter 13 Bankruptcy

Chapter 7 Entrepreneurship Starting A Business Fundamentals Of Business

Parler Ceo Says Service Dropped By Every Vendor Could End Business Deadline

Bankruptcy Basics The Ultimate Bankruptcy Law Introduction Talkov Law

Ex 99 1 3 Tm2135528d1 Ex99 1 Htm Exhibit 99 1 Exhibit

Retail Companies Filing For Bankruptcy During Covid 19 Intellizence

/GettyImages-924615116-c521736490324917aa74600de99ee0c5.jpg)

How To Protect Your Assets From A Lawsuit Or Creditors

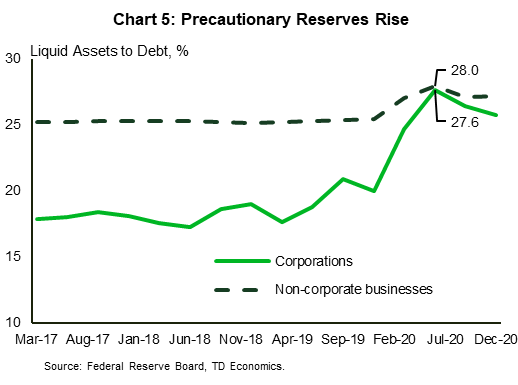

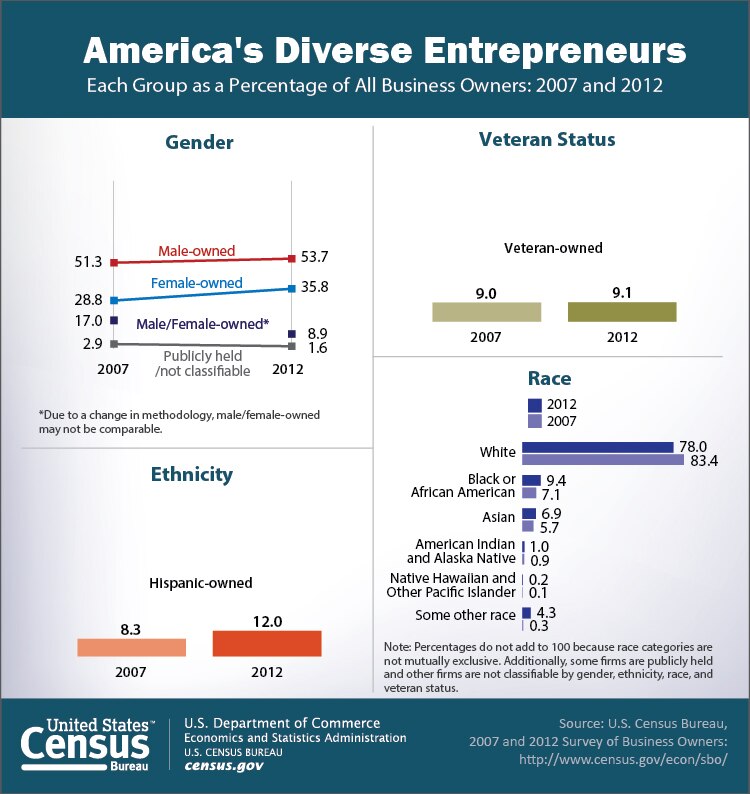

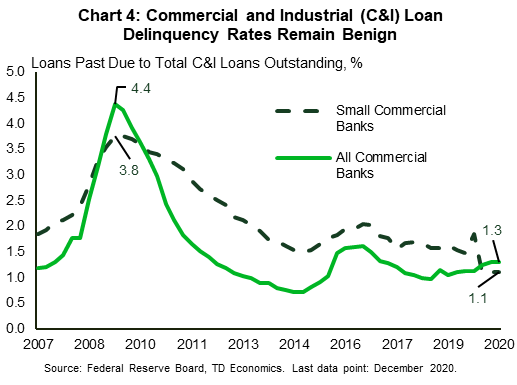

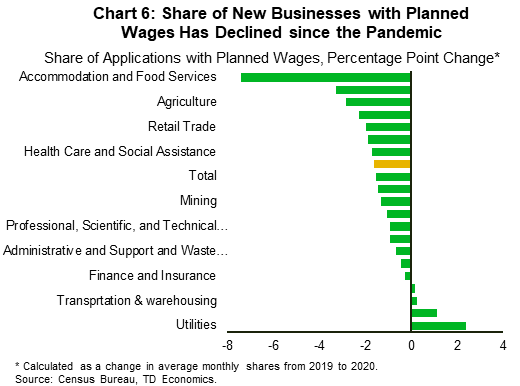

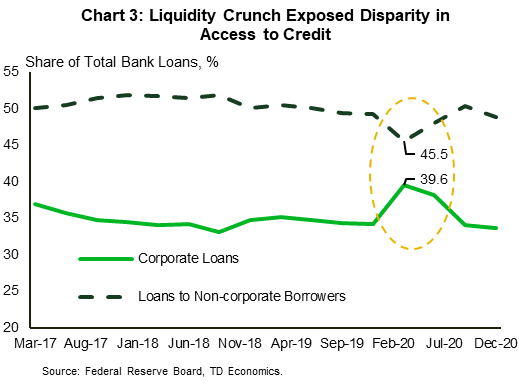

The Business Of America Is Small Business Heeding The Lessons Of The Pandemic

The Business Of America Is Small Business Heeding The Lessons Of The Pandemic

The Year In Bankruptcy 2021 Insights Jones Day

Four Points To Consider Regarding Insolvency Gallagher Usa

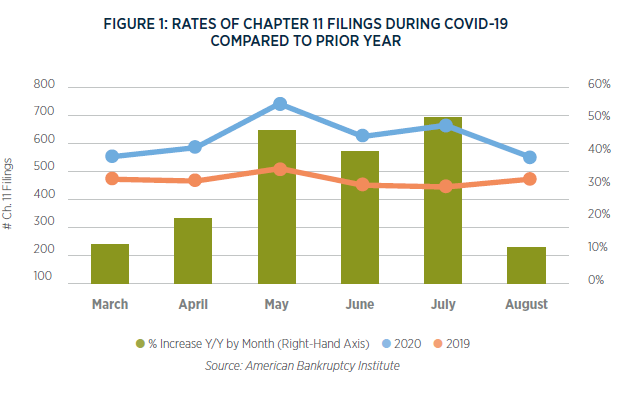

The Business Of America Is Small Business Heeding The Lessons Of The Pandemic

Canadian Business And The Law Top Hat Book Shop

The Business Of America Is Small Business Heeding The Lessons Of The Pandemic

/bankruptcy-broker-brokerage-firm-56a0911b3df78cafdaa2cad4.jpg)

Comments

Post a Comment